Warren Buffett is one of the greatest financial minds in the world… and guess what? He’s a big fan of mortgages. While he is generally a critic of consumer debt, he thinks mortgages are incredibly attractive financial instruments due to a feature he calls a “one-way renegotiation”. What he means by this, is that mortgages have the ability to be refinanced.

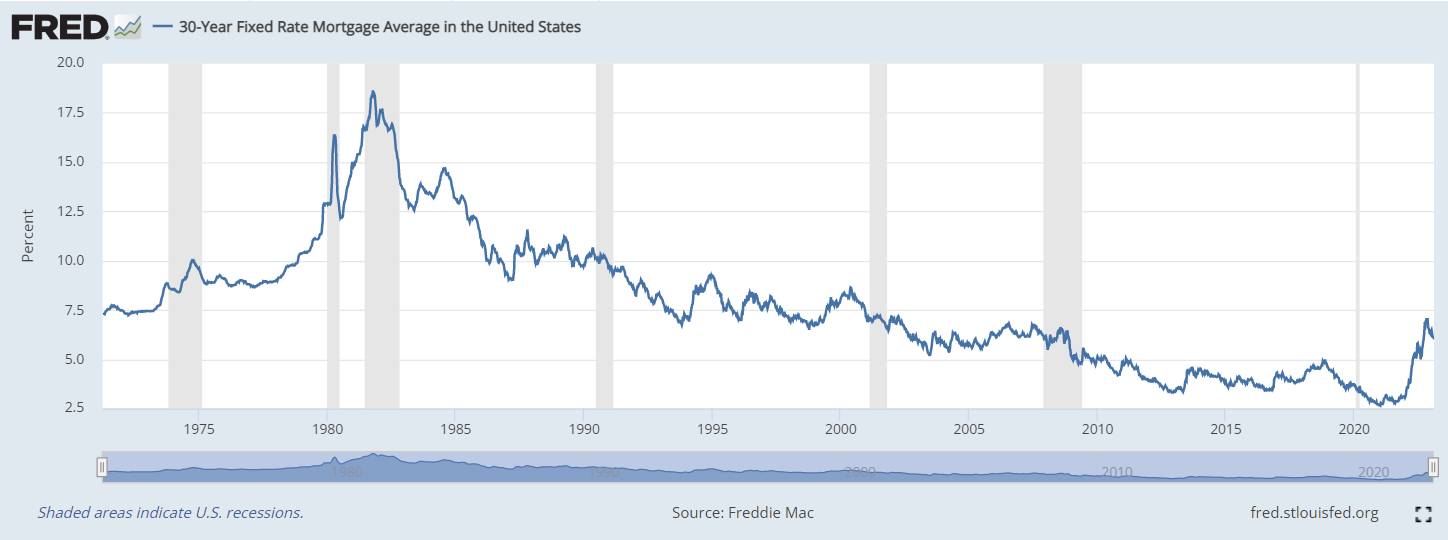

So, let’s say you obtain a 30 year, fixed-rate mortgage today at 6.00% interest. That is the highest your borrowing costs will ever be for three decades. But, if mortgage rates drop at any point over the next 30 years, then you can simply replace your loan with a new one at current interest rates. On the other hand, your interest rate can never go up with a fixed-rate mortgage.

A mortgage is also unique in that it is one of the only types of lower-interest debt that is attached to an appreciating asset. (You can refinance a car loan, but that asset typically declines rapidly in value).

“It’s a one-way renegotiation. It is an incredibly attractive instrument for the homeowner and you’ve got a one-way bet.” – Warren Buffett

Many aspiring homebuyers have been discouraged by housing affordability with the simultaneous jump in home prices and interest rates. But the “one-way renegotiation” feature of most mortgages should provide a glimmer of hope. When you’re purchasing a home, you do not need to “wait for interest rates to go down” (a line I commonly hear in my role as a mortgage loan originator). As long as you’re comfortable with the monthly mortgage payment when you buy your home, you can rest assured that if mortgage interest rates ever drop, you can take advantage of it by refinancing.

I’ve provided a graph below created from Federal Reserve Economic Data that shows 30-year fixed mortgage rates since the 1970’s. While it’s important to note that no one knows what interest rates will do in the future, the data suggests that it is likely you’ll have an opportunity to refinance.

Warren Buffet stands behind his opinion of mortgages as a valuable financial instrument by using them himself to buy real estate in the past despite being very wealthy. He thought he could make more money by investing those funds, than it would cost him by borrowing them with a mortgage. This should always be a consideration when financing real estate, and when determining your down payment amount. More on that another time…

Subscribe below to follow along to get all of your questions answered and to get excited about building wealth with property!